Condo Insurance in and around Riverside

Riverside! Look no further for condo insurance

Condo insurance that helps you check all the boxes

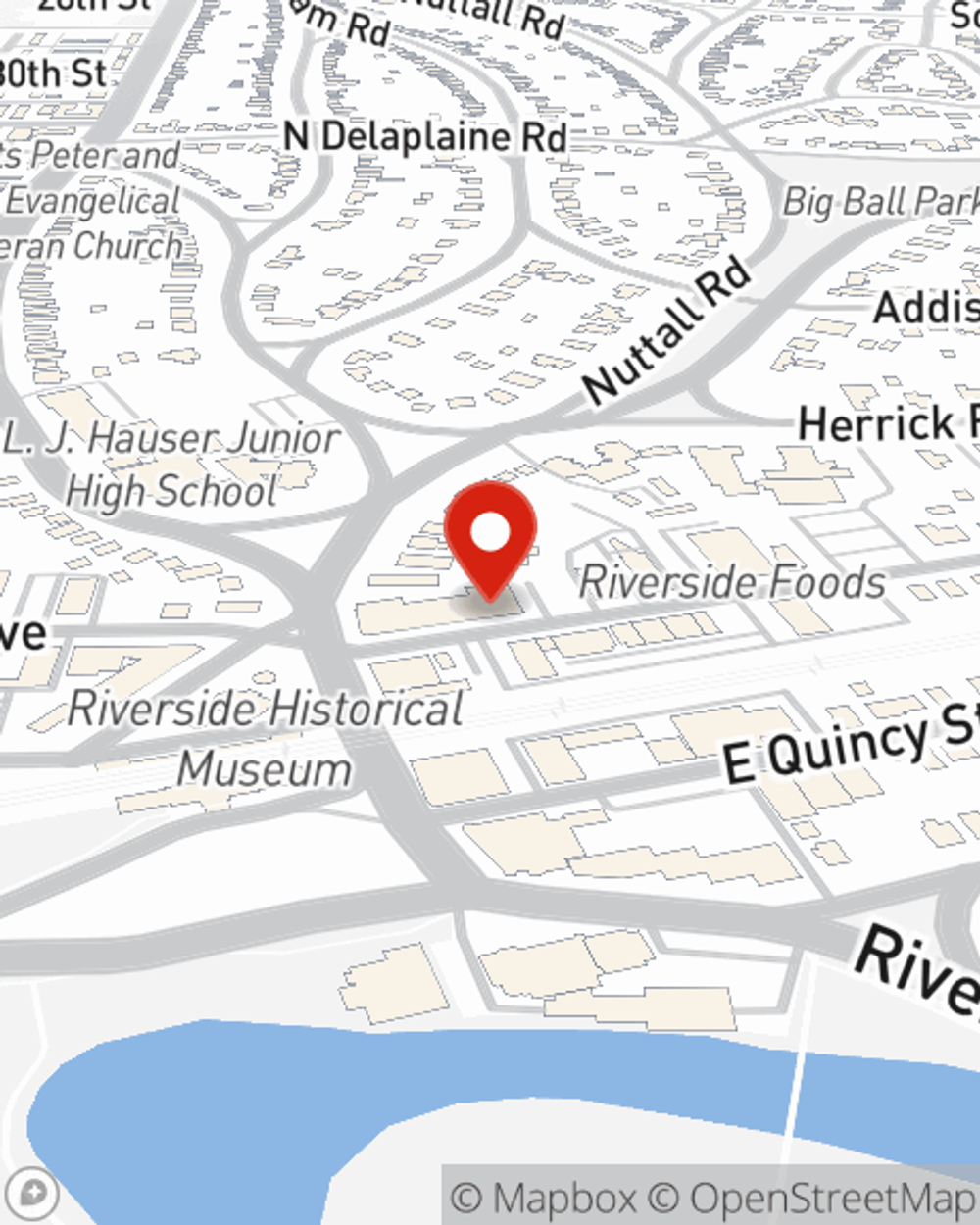

- Riverside, IL

- Lyons, IL

- Berwyn, IL

- Cicero, IL

- LaGrange, IL

- Westchester, IL

- Brookfield, IL

- Cook County, IL

- DuPage County, IL

- Elmhurst, IL

- North Riverside, IL

- Illinois, US

There’s No Place Like Home

The life you hold dear is rooted in the condo you call home. Your condo is where you kick back, laugh and play and relax. It’s where you build a life with family and friends.

Riverside! Look no further for condo insurance

Condo insurance that helps you check all the boxes

State Farm Can Insure Your Condominium, Too

We get it. That's why State Farm offers terrific Condo Unitowners Insurance that can help protect both your unit and the personal property inside. Agent Mike Adelsbach is here to help you understand your options - including benefits, savings, bundling - helping you create a customizable plan that's right for you.

Don’t let concerns about your condo keep you up at night! Contact State Farm Agent Mike Adelsbach today and explore how you can benefit from State Farm Condominium Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Mike at (708) 447-1630 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Mike Adelsbach

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.