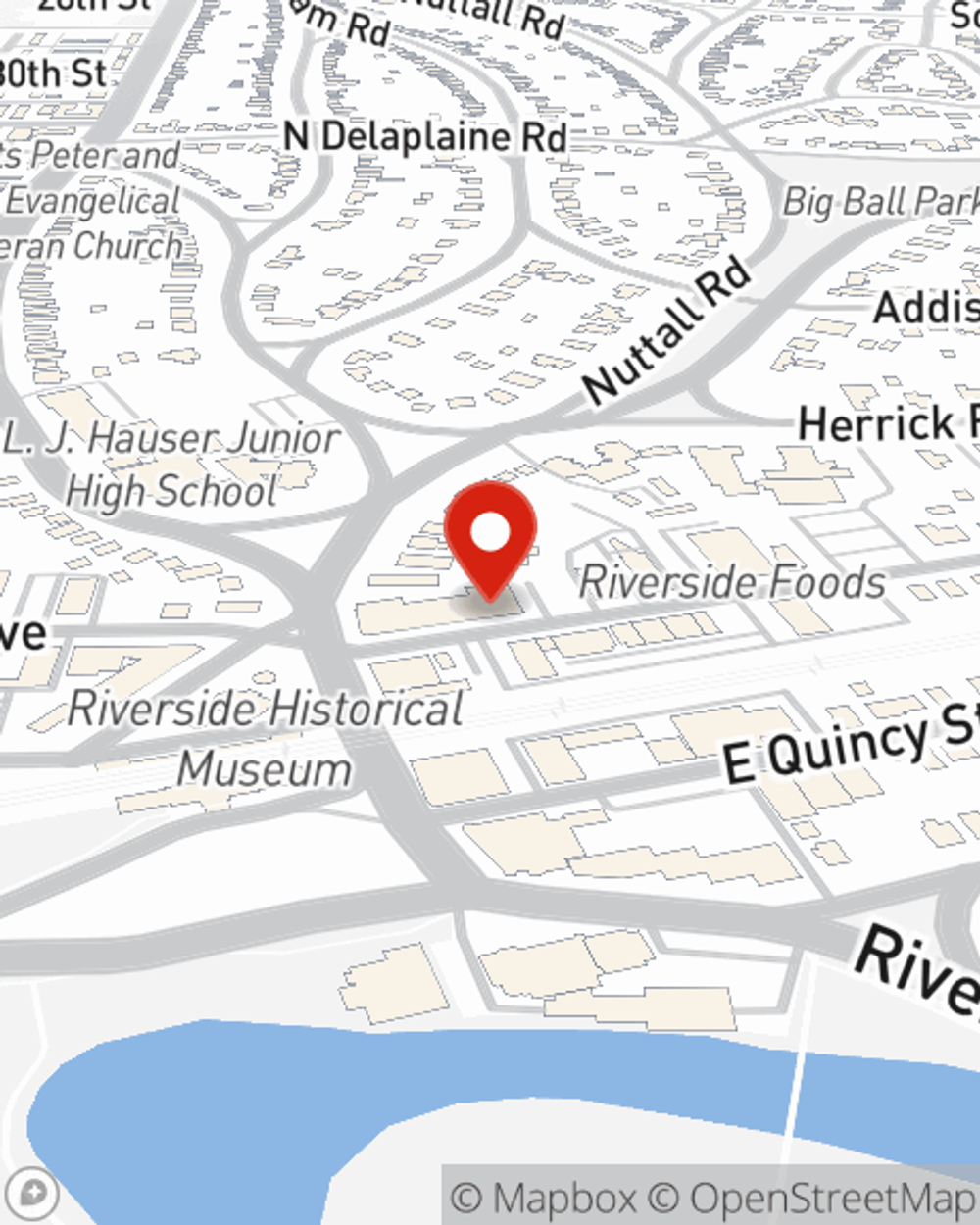

Business Insurance in and around Riverside

Researching insurance for your business? Search no further than State Farm agent Mike Adelsbach!

No funny business here

- Riverside, IL

- Lyons, IL

- Berwyn, IL

- Cicero, IL

- LaGrange, IL

- Westchester, IL

- Brookfield, IL

- Cook County, IL

- DuPage County, IL

- Elmhurst, IL

- North Riverside, IL

- Illinois, US

Cost Effective Insurance For Your Business.

As a business owner, you have to think about all areas of business, all the time. The details can be overwhelming! You can save time by working with State Farm agent Mike Adelsbach. Mike Adelsbach can relate to where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your concerns and frees you to focus on growing your business into the future.

Researching insurance for your business? Search no further than State Farm agent Mike Adelsbach!

No funny business here

Get Down To Business With State Farm

Whether you are a podiatrist an HVAC contractor, or you own a candy store, State Farm may cover you. After all, we've been doing it for almost 100 years! State Farm agent Mike Adelsbach can help you discover coverage that's right for you and your business. Your business policy can cover things such as equipment breakdown and money.

At State Farm agent Mike Adelsbach's office, it's our business to help insure yours. Visit our excellent team to get started today!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Mike Adelsbach

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.